The Minimum Wage Scotland is governed by both UK-wide legislation and specific regulations tailored to the country’s unique economic landscape. The minimum wage refers to the lowest hourly rate that employers are legally obligated to pay their employees. It serves as a fundamental labor protection measure aimed at ensuring that workers receive fair compensation for their work. By establishing a minimum wage, governments seek to prevent exploitation, alleviate poverty, and promote social and economic equality within the workforce. It sets a standard for wages, ensuring that workers can afford basic necessities and maintain a decent standard of living. Additionally, the minimum wage can stimulate consumer spending, contribute to economic stability, and foster a more equitable distribution of wealth.

The importance of minimum wage laws cannot be overstated, as they play a crucial role in safeguarding the rights and well-being of workers. These laws help prevent the exploitation of vulnerable workers, particularly those in low-wage sectors or with limited bargaining power. By setting a floor on wages, minimum wage laws contribute to reducing income inequality and addressing social disparities. They also promote workforce productivity and motivation by ensuring that workers are fairly compensated for their contributions. Moreover, minimum wage laws can have positive ripple effects on local economies, as increased purchasing power among workers can boost consumer demand and support small businesses.

The National Minimum Wage (NMW) and National Living Wage (NLW) are the two main wage rates established by law, with the NLW set at a higher rate for workers aged 23 and over. The Scottish Government has also expressed its commitment to fair work practices and has implemented initiatives such as the Fair Work Framework to promote fair wages, job security, and employee rights across various sectors. While minimum wage rates in Scotland generally align with those in the rest of the UK, there are ongoing discussions and debates about the adequacy of minimum wage levels and the need for further reforms to address issues such as wage stagnation and cost of living concerns.

Table of Contents

ToggleWhat is Minimum Wage in Scotland?

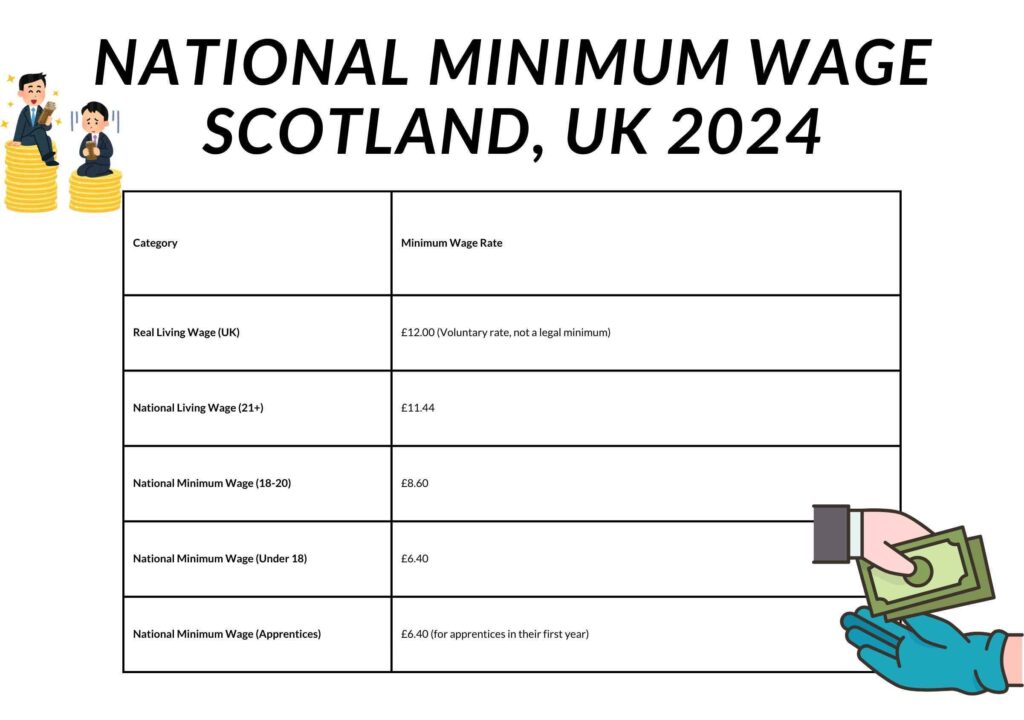

In Scotland, the minimum wage varies based on age and whether someone is an apprentice. Here are the current rates (as of April 8, 2024):

| Category |

Minimum Wage Rate

|

| Real Living Wage (UK) |

£12.00 (Voluntary rate, not a legal minimum)

|

| National Living Wage (21+) | £11.44 |

| National Minimum Wage (18-20) | £8.60 |

| National Minimum Wage (Under 18) | £6.40 |

| National Minimum Wage (Apprentices) |

£6.40 (for apprentices in their first year)

|

Key Points:

- The Real Living Wage is voluntary and higher than the government-mandated minimum wage, aiming to reflect the actual cost of living in Scotland.

- The National Living Wage (NLW) is for workers aged 21 and over.

- Younger workers and first-year apprentices have lower minimum wage rates under the National Minimum Wage (NMW).

Additional Notes:

- These rates are per hour. Your actual salary depends on your weekly working hours.

- The provided information accurately outlines the various minimum wage tiers in Scotland.

Minimum Wage in Glasgow Scotland

There isn’t a distinct minimum wage specifically for Glasgow, Scotland. The entire region follows the national minimum wage framework, which encompasses the Real Living Wage and the National Living Wage/National Minimum Wage (NMW) based on age and apprenticeship status (as of April 1, 2024).

Here’s a concise breakdown:

- Real Living Wage (voluntary): £12.00 per hour (This rate is recommended for maintaining a decent standard of living in Scotland)

- National Living Wage (NLW) for individuals aged 21 and above: £11.44 per hour (This is the legally mandated minimum for most workers)

- National Minimum Wage (NMW) for different age brackets:

- 18-20 years old: £8.60 per hour

- Under 18 years old: £6.40 per hour

- Apprentices in their first year: £6.40 per hour (This increases to the relevant NMW rate based on age in subsequent years)

Therefore, whether you’re employed in Glasgow or any other part of Scotland, these minimum wage rates remain applicable.

Minimum Wage Scotland For 16 Year Olds

For employees aged 16 and 17 in Scotland, the minimum wage is £6.40 per hour as of April 2024. This rate applies to all workers above the school leaving age employed by an employer.

Here’s a brief breakdown:

- Age Group: 16-17 years old

- Minimum Wage: £6.40 per hour

Here’s a summary of the UK minimum wage rates (as of April 1, 2024):

| Age Group |

April 2024 Minimum Wage

|

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

It’s essential to note that this rate represents the minimum legal requirement. However, certain employers may offer higher wages to attract and retain young talent.

Additionally, Scotland embraces the Real Living Wage, which currently stands at £10.90 per hour. Although voluntary, some employers, including those hiring workers aged 16 and 17, opt to pay this rate. While not compulsory by law, it’s worth considering when seeking your first employment opportunity.

Minimum Wage Scotland For 18 Year Olds

In Scotland, 18-year-olds fall under the National Living Wage category set by the UK government. As of April 2024, the minimum hourly rate for individuals aged 18 to 20 is £8.60.

However, it’s crucial to consider an alternative option:

The Real Living Wage: This is a voluntary rate independently calculated in Scotland, currently set at £12.00 per hour and applicable to all workers aged 18 and above. While not obligatory, certain employers in Scotland choose to pay their employees the Real Living Wage rather than the minimum wage.

Here’s a brief comparison:

| Wage Type | Age Requirement |

Minimum Hourly Rate (April 2024)

|

| National Living Wage | 18-20 year olds | £8.60 |

| Real Living Wage (Voluntary) | 18+ | £12.00 |

If you’re unsure about which wage applies to you, it’s advisable to directly inquire with your employer. Additionally, you can find more information about the National Living Wage and Real Living Wage rates on the following websites:

- National Minimum Wage and National Living Wage rates: https://checkyourpay.campaign.gov.uk/

- Scottish Living Wage: https://scottishlivingwage.org/

Minimum Wage Scotland For 17 Year Olds

For 17-year-old workers in Scotland, assuming they’ve passed the school leaving age, the minimum wage is £6.40 per hour starting from April 1st, 2024.

Here’s a quick summary:

- Age: 17 and over (past school leaving age)

- Minimum Wage: £6.40 per hour

It’s essential to note that this rate represents the minimum legal requirement. However, some employers may offer higher wages based on factors such as experience, qualifications, or their choice to follow the voluntary Real Living Wage.

Real Living Wage in Scotland:

Scotland recommends a higher rate known as the Real Living Wage, currently set at £10.90 per hour as of April 2024. While not mandatory, certain employers opt to pay this rate as it’s seen as a more accurate reflection of living costs.

Resources:

If you’re interested in learning more about minimum wage rates in Scotland, you can refer to these resources:

- UK National Minimum Wage and National Living Wage rates: https://www.nidirect.gov.uk/articles/national-minimum-wage-and-living-wage

- National Minimum Wage – Young Scot: https://young.scot/get-informed/national-minimum-wage

Minimum Wage Scotland 2023 Over 25

In Scotland (and across the UK), the minimum wage structure has evolved since April 2021, no longer being solely based on age 25 and older. Instead, it transitioned to the National Living Wage system, applicable to workers aged 23 and above.

Here’s a summary of the minimum wage for over 25s in Scotland for the year 2023:

- April 2023 – March 2024: The National Living Wage for individuals aged 23 and over was £10.42 per hour.

However, it’s crucial to highlight that starting from April 2024, there has been another increase in the minimum wage:

- April 2024 onwards: The National Living Wage for those aged 23 and over has risen to £11.44 per hour.

Minimum Wage Scotland Increase

Scotland itself does not establish its own minimum wage; instead, the entire UK adheres to the UK National Living Wage and National Minimum Wage rates.

As of April 1st, 2024, there was a substantial increase in the minimum wage. Here’s a breakdown of the increase:

- Previous Rate (as of April 2023): £10.42 per hour for individuals aged 23 and over (National Living Wage)

- New Rate (as of April 2024): £11.44 per hour for those aged 21 and over (National Living Wage)

This signifies an increase of £1.02 per hour, marking almost a 10% rise. It stands as the most significant increase in the last decade!

One additional point to note is that the separate category for ages 21-22 has been eliminated. Now, everyone aged 21 and over qualifies for the National Living Wage of £11.44.

Implementation and Enforcement

In Scotland, the enforcement of the National Living Wage and National Minimum Wage is overseen by the UK Government’s Department for Business, Energy, and Industrial Strategy (BEIS) through their agency, the Enforcement and Sanctions Team (EAST).

Processes for Setting and Adjusting Minimum Wage Rates

- Research Conducted by the Low Pay Commission (LPC):

- Analyzes economic data, living costs, and productivity.

- Determines appropriate wage levels based on their research.

- Consultations with Stakeholders:

- Gathers input from employers’ organizations, trade unions, and relevant groups.

- Recommendations to the Government:

- Proposes new minimum wage rates to the government based on research and consultations.

- Government generally accepts LPC’s recommendations, with the final decision resting with them.

- Minimum wage rates are typically reviewed annually, taking effect in April.

Measures for Ensuring Compliance by Employers

- Complaints Process:

- Workers can lodge complaints with BEIS if they believe they’re not receiving the minimum wage.

- Inspections:

- BEIS conducts targeted and random inspections of workplaces to check wage records and ensure compliance.

- Fines and Penalties:

- Employers found underpaying workers face fines and may be required to pay back owed wages.

- Public Awareness Campaigns:

- BEIS runs campaigns to educate employers and workers about their rights and responsibilities concerning minimum wage.

- Naming and Shaming:

- In severe cases, BEIS publicly names employers significantly breaching minimum wage regulations.

Additional Notes:

- Workers’ organizations like trade unions can advise workers of their rights and help with complaints.

- Advocacy groups may provide support and resources to workers experiencing underpayment.

- Through these measures, the government aims to create a robust enforcement system safeguarding workers’ rights and deterring underpayment practices.

Impact of Minimum Wage

The minimum wage system in Scotland, aligned with the UK National Living Wage and National Minimum Wage, exerts a diverse range of impacts. Here’s a breakdown of its potential effects:

Economic Effects on Workers and Businesses

For Workers:

- Increased Wages: Directly leads to higher incomes for low-wage workers, which can enhance living standards and diminish in-work poverty.

- Job Security: Minimum wage hikes may incentivize businesses to retain staff instead of resorting to layoffs to manage costs.

- Skilled Labor Focus: Some businesses might prioritize hiring higher-skilled workers or investing in automation to rationalize wage expenses.

For Businesses:

- Labor Costs: Immediate impact includes heightened labor expenses, prompting businesses to consider price hikes, reduced work hours, or efficiency investments.

- Hiring Decisions: Sectors with narrow profit margins may hesitate to hire new staff due to the raised wage floor.

- Innovation: Pressures to control costs may fuel innovation and productivity enhancements.

Social Implications and Effects on Poverty Levels

- Reduced Income Inequality: Elevating wages for low-income earners can contribute to narrowing income gaps.

- Improved Living Standards: Enhanced income can translate into better housing, healthier food choices, and greater social participation, enhancing overall quality of life.

- Reduced Poverty: Minimum wage increments can positively influence in-work poverty rates, though the extent of this impact is subject to debate.

Case Studies or Examples Demonstrating Minimum Wage Impact in Scotland

- Limited Data: Due to the recent adoption of the National Living Wage system in Scotland, there’s a scarcity of long-term impact data. However, potential effects include:

- Positive Outcomes: Research suggests minimum wage hikes can elevate living standards and diminish in-work poverty, notably benefiting low-paid women and young workers.

- Challenges: Certain sectors like hospitality and retail may encounter difficulties adapting to higher labor costs, sparking ongoing discussions regarding job creation and hours offered.

Overall, the minimum wage’s impact in Scotland is multifaceted. While it can enhance the lives of low-wage workers and potentially curb poverty, it also presents challenges for some businesses. Continuous monitoring and research are essential to comprehensively grasp the long-term ramificatios.

Debates and Controversies

The ongoing discussion surrounding Scotland’s minimum wage, in line with the UK’s National Living Wage and National Minimum Wage system, encompasses various arguments and challenges. Here’s a detailed breakdown:

Arguments for and Against Raising the Minimum Wage

For Raising the Minimum Wage:

- Improved Living Standards: Advocates posit that increasing the minimum wage elevates income for low-wage workers, thereby enhancing their quality of life and reducing in-work poverty.

- Economic Stimulus: Higher wages can potentially boost consumer spending, benefiting businesses and fostering economic growth.

- Income Inequality Reduction: A heightened minimum wage may contribute to narrowing the wealth gap and promoting a more equitable society.

Against Raising the Minimum Wage:

- Job Losses: Opponents argue that businesses might resort to layoffs or reduced work hours to manage increased labor costs.

- Price Hikes: Businesses may increase prices to offset higher wage expenses, potentially impacting consumers, particularly low-income households.

- Competitiveness Challenges: Some sectors, especially those with narrow profit margins, express concerns that a higher minimum wage could reduce their competitiveness compared to regions with lower wage standards.

Challenges Faced in Implementation and Enforcement

- Determining the Optimal Rate: Striking a balance between workers’ needs and business affordability when setting the minimum wage is a complex endeavor.

- Sector-Specific Impacts: Different industries may experience varied effects, with sectors like hospitality potentially encountering more significant challenges.

- Enforcement Hurdles: Ensuring universal compliance with the minimum wage necessitates sufficient resources for inspections and addressing complaints.

- Underground Economy Risks: Businesses might engage in under-the-table payments to circumvent higher labor costs, posing difficulties in monitoring and enforcement.

Stakeholder Perspectives and Proposed Solutions

- Workers and Unions: Advocating for periodic minimum wage increases aligned with living costs, they may propose rates higher than those recommended by the Low Pay Commission.

- Businesses: Lobbying for gradual increases or targeted adjustments for specific sectors, alongside proposing tax breaks or incentives to offset wage costs.

- Government: Balancing worker and business interests while considering broader economic impacts, potential solutions could include support programs or tax incentives for struggling businesses.

Proposed Solutions:

- Living Wage vs. Minimum Wage: Shifting towards a higher “living wage” reflective of actual living expenses, rather than just a minimum threshold.

- Regional Variations: Considering regional cost-of-living disparities when determining minimum wage rates.

- Sector-Specific Adjustments: Tailoring minimum wage adjustments for sectors facing distinct challenges.

- Focus on Training and Skills: Investing in skill development programs to enhance employability and justify higher wages.

The complexity of Scotland’s minimum wage debate necessitates ongoing dialogue among stakeholders, backed by research and evidence, to ensure effective implementation and balance between economic and social objectives.

FAQ

What is the National Minimum Wage?

The UK has shifted from using the term “National Minimum Wage” to the “National Living Wage” for workers aged 23 and above since April 1st, 2021.

However, different minimum wage rates still apply to younger workers:

- National Living Wage (Age 23 and above): £11.44 per hour (as of April 1, 2024)

- National Minimum Wage Rates:

- Age 18 to 20: £8.60 per hour

- Under 18: £6.40 per hour (for those above school leaving age)

- Apprentice: £6.40 per hour (same as under 18 rate)

It’s crucial to note that these rates represent the minimum legal requirements. Some employers may opt to pay higher wages based on factors like experience, qualifications, or adherence to the voluntary Real Living Wage, which surpasses the National Living Wage.

Who is eligible for the National Minimum Wage?

In the UK, individuals classified as “workers” are entitled to receive either the National Minimum Wage or the National Living Wage, depending on their age:

- School Leaving Age and Above: Those who have reached at least the school leaving age, typically occurring on the last Friday in June of the school year when they turn 16, qualify for the National Minimum Wage.

- Age 23 and Over: Workers aged 23 and above are entitled to the higher National Living Wage.

Here’s a breakdown of eligibility:

National Minimum Wage applies to:

- Workers aged 18 to 20

- Workers under 18 who have surpassed school leaving age

- Apprentices of any age

National Living Wage applies to:

- Workers aged 23 and over

Additional Points:

- Worker classification encompasses a broader scope beyond traditional “employees,” including freelancers, agency workers, and certain home workers.

- These rates represent the minimum legal standards, and employers have the discretion to pay above the minimum wage.

- Scotland aligns with the same National Living Wage and National Minimum Wage rates as the rest of the UK.

What are the current National Minimum Wage rates in Scotland and the UK?

In Scotland, the terminology of “National Minimum Wage” is no longer utilized. Instead, the entire UK operates under a unified system featuring two primary rates:

National Living Wage (Age 23 and Over): £11.44 per hour (effective from April 1, 2024) National Minimum Wage Rates:

- Age 18 to 20: £8.60 per hour

- Under 18 (for those above school leaving age): £6.40 per hour

- Apprentice (of any age): £6.40 per hour (same as the under 18 rate)

It’s crucial to note that these figures represent minimum thresholds. Some employers may offer higher wages based on factors such as experience, qualifications, or adherence to the voluntary Real Living Wage, which currently stands at £12.00 per hour (as of April 1, 2024) in Scotland.

Is there a separate minimum wage for Scotland?

There is no distinct minimum wage for Scotland; the entire UK adheres to uniform National Living Wage and National Minimum Wage rates.

Previously, an age-based minimum wage structure existed but was replaced in April 2021 with the current system. Workers aged 23 and over now receive the National Living Wage, while younger workers are entitled to the National Minimum Wage.

Whether you work in Glasgow, London, or any other UK region, your minimum wage is determined by your age and aligns with national rates.

Hi there! I’m Loanna Morrison, a dedicated Civil Servant serving the public interest within the UK government. With a passion for ensuring fair labor practices and equitable treatment in the workforce, I’m deeply committed to advocating for policies that promote the well-being of workers across the United Kingdom.

As the mind behind MinimumWageUK.co.uk, I strive to provide valuable resources and up-to-date information regarding minimum wage regulations in the UK. With a focus on transparency and accessibility, my goal is to empower both employees and employers with the knowledge they need to navigate the complexities of minimum wage laws effectively.

With years of experience in public service and a keen understanding of labor policies, I’m here to support individuals and businesses alike in achieving compliance and fostering a workplace environment that values and respects the contributions of every worker.

Join me in the pursuit of a fairer, more equitable labor landscape for all. Together, we can make a meaningful difference in the lives of workers across the UK.