The Minimum Wage Salary 40 Hours a Week forms the foundation of economic security for many individuals, ensuring they can afford essentials such as housing, food, and healthcare. The minimum wage, often referred to as the lowest legal wage that employers can pay their employees, plays a crucial role in ensuring fair compensation for labor. It is a standard set by governments to protect workers’ rights and prevent exploitative labor practices. Minimum wage laws establish the minimum hourly rate that employers must pay their employees, guaranteeing a baseline level of income.

Understanding and discussing the minimum wage salary for full-time work, typically based on a 40-hour workweek, is essential for several reasons. Firstly, it sheds light on the financial stability and livelihoods of workers who rely on this income to meet their basic needs and support their families.

Moreover, discussions about minimum wage salary for full-time work highlight the broader socioeconomic implications. It brings attention to income inequality, the cost of living, and the overall well-being of the workforce. By examining the adequacy of the minimum wage salary for 40 hours a week, we can address issues of poverty, social justice, and economic opportunity.

In essence, discussing the minimum wage salary for full-time work is not just about numbers; it’s about recognizing the dignity of labor, advocating for fair compensation, and promoting economic stability and equality within society.

Table of Contents

ToggleMinimum Wage Salary 40 Hours a Week

Assuming we’re talking about the UK and someone aged 21 or older qualifying for the National Living Wage (NLW):

- Minimum Wage per Hour: £11.44 (effective April 1, 2024)

- Weekly Salary for 40 Hours: £11.44/hour * 40 hours/week = £457.64

- Annual Salary:

To find the yearly salary, multiply the weekly salary by the number of working weeks in a year, accounting for holidays:

- 52 Weeks (excluding holiday deductions): £457.64/week * 52 weeks/year = £23,797.60

- 46 Weeks (adjusting for typical paid vacation): £457.64/week * 46 weeks/year = £21,143.84

We’ve put together the following table to provide a clearer understanding of how this will affect your salaries:

| Minimum Wage Age 21 and over Hours worked |

From 1 April 2023 (£10.42 per hour)

|

From April 2024 (£11.44 per hour)

|

|||

| per week | Per Week | Salary per annum | NEW Per Week | Salary per annum |

Increase per annum

|

| 35 | £364.70 | £18,964.40 | £400.44 | £20,822.90 | £1,858.50 |

| 36 | £375.12 | £19,506.24 | £411.88 | £21,417.85 | £1,911.61 |

| 37 | £385.54 | £20,048.08 | £423.32 | £22,012.80 | £1,964.72 |

| 37.5 | £390.75 | £20,319.00 | £429.04 | £22,310.26 | £1,991.26 |

| 38 | £395.96 | £20,589.92 | £434.76 | £22,607.73 | £2,017.81 |

| 39 | £406.38 | £21,131.76 | £446.20 | £23,202.67 | £2,070.91 |

| 40 | £416.80 | £21,673.60 | £457.64 | £23,797.60 | £2,124.00 |

| 41 | £427.22 | £22,215.44 | £469.08 | £24,392.55 | £2,177.11 |

| 42 | £437.64 | £22,757.28 | £480.52 | £24,987.50 | £2,230.22 |

| 43 | £448.06 | £23,299.12 | £491.97 | £25,582.43 | £2,283.31 |

| 44 | £458.48 | £23,840.96 | £503.41 | £26,177.40 | £2,336.44 |

| 45 | £468.90 | £24,382.80 | £514.85 | £26,772.30 | £2,389.50 |

Key Points:

- These figures are based on the current NLW for individuals aged 21 and above in the UK. Different rates may apply to younger workers or those in their first year of an apprenticeship.

- The annual salary calculations do not factor in deductions for taxes, National Insurance, or other contributions, which would lower your actual take-home pay.

- For more details or to verify your specific pay, visit GOV.UK’s National Living Wage page at https://checkyourpay.campaign.gov.uk/.

Minimum Wage Yearly Salary UK 40 Hours a Week

Two primary factors are crucial when determining the yearly minimum wage salary for a 40-hour workweek in the UK:

- Age and Stage (For Under 21):

For individuals under 21, the minimum wage depends on their age and, in some cases, their stage in an apprenticeship program. However, this factor is irrelevant if you’re specifically focusing on individuals aged 21 or older.

- National Living Wage (NLW):

The minimum wage for workers aged 21 and above is termed the National Living Wage (NLW). As of April 1, 2024, the NLW stands at:

- £11.44 per hour

Yearly Salary Calculation:

You can calculate the yearly salary in two primary ways:

- 52 Weeks (excluding holiday deductions): This method assumes a full year of work without paid holidays or bank holidays. Calculation: Weekly wage x 52 weeks/year Example: £11.44/hour * 40 hours/week * 52 weeks/year = £23,797.60

- 46 Weeks (allowing for typical paid vacation): This approach considers usual paid vacation time (about 4-6 weeks annually). Calculation: Weekly wage x 46 weeks/year Example: £11.44/hour * 40 hours/week * 46 weeks/year = £21,143.84

Key Points:

- These calculations serve as examples and do not include deductions for taxes, National Insurance, or other contributions, which will reduce your actual take-home pay.

- If you’re interested in the minimum wage for individuals under 21, their age and apprenticeship stage (if applicable) are critical. They might qualify for a lower minimum wage rate than the NLW.

For more details or to verify specific pay rates, refer to GOV.UK’s National Living Wage page: https://checkyourpay.campaign.gov.uk/

Minimum Wage Salary 40 Hours a Week UK After Tax

Calculating the precise take-home pay (post-tax) for a 40-hour minimum wage salary in the UK is intricate due to various factors:

- National Living Wage (NLW): This is the minimum wage for individuals aged 21 and above, set at £11.44 per hour as of April 1, 2024.

- Weekly Salary: Working 40 hours at the NLW yields £11.44/hour * 40 hours/week = £457.64 per week.

- Tax:

The UK income tax system is progressive, meaning your tax rate increases as your income surpasses a certain threshold (personal allowance). Your tax rate and total tax owed hinge on several specifics, including:

- Tax code: Issued by HMRC, this determines your personal allowance and tax bracket.

- Other income: Additional income from sources like a side job influences your total taxable income and tax bracket.

To estimate your take-home pay:

- Online Tax Calculators: Use these for a rough estimate based on your weekly salary and tax code, though they may not be entirely precise.

- HMRC Tax Estimator: For a more tailored estimate, use HMRC’s calculator: https://www.gov.uk/estimate-income-tax

Important Points:

- Your tax code, available on your payslip or from HMRC, is needed for accurate estimation.

- Even with a tax code, the estimate may not be exact, as it excludes potential deductions like National Insurance contributions, student loan repayments, or pension contributions.

Alternative Methods for Take-Home Pay Calculation:

- Consult your employer: They can provide an estimated take-home pay based on your specifics.

- Analyze your payslip: Your first payslip will outline gross pay, deductions (including tax and National Insurance), and net pay (take-home pay).

Understanding Deductions:

- Income Tax: The primary deduction from your salary.

- National Insurance: A social security contribution for public services like healthcare.

- Other deductions: Your employer might deduct additional amounts for items like student loan repayments, pension contributions, or union fees.

In summary, while we can’t give an exact post-tax take-home pay without your tax code and details, the resources and information provided can aid in a more accurate estimation.

Minimum Wage Yearly Salary UK 2022 40 Hours a Week

Here’s a detailed breakdown of the minimum wage salary in the UK for a 40-hour workweek spanning four years, categorized by age group (Apprentices and 23+), highlighting the significant increase in the minimum wage over time:

| Year | Minimum Wage for Apprentices (per hour) | Minimum Wage for Age 23+ (per hour) |

Yearly Salary (Age 23+, 40 hours/week)

|

| 2022/2023 | £4.81 | £9.50 |

£19,851 (calculated as £9.50 * 40 * 52)

|

| 2021/2022 | £4.30 | £8.91 | £18,535.20 |

| 2020/2021 | £4.15 | £8.72 | £18,134.40 |

| 2019/2020 | £3.90 | £8.21 | £17,100.80 |

Key Observations:

- The minimum wage for apprentices is consistently lower than that for individuals aged 23+.

- There’s a notable and steady increase in the minimum wage over the past four years.

- Yearly salary computations involve multiplying the hourly wage by the number of working hours per week (40) and the number of weeks in a year (typically 52).

Additional Insights:

- This table reflects only the minimum wage rates; some employers may offer higher wages based on factors such as job role, experience, or geographical location.

- The yearly salary figures presented do not factor in deductions for taxes, National Insurance, or other contributions, leading to a lower actual take-home pay.

Minimum Wage 27 Year Old Salary 40 Hours a Week

Given that a 27-year-old exceeds the minimum wage age requirement in the UK (which currently stands at 21 and above), their minimum wage is determined by the National Living Wage (NLW) as of April 1, 2024, which is £11.44 per hour.

Here’s a detailed breakdown:

- Hourly Wage: £11.44 (National Living Wage)

- Weekly Working Hours: 40 hours

Calculating Weekly Salary:

Weekly Salary = Hourly Wage * Working Hours Weekly Salary = £11.44/hour * 40 hours/week = £457.64

Yearly Salary Estimates (pre-deductions):

There are two approaches to estimating the yearly salary, based on how you factor in paid holidays:

- 52 Weeks (without holiday deductions): £457.64/week * 52 weeks/year = £23,797.60

- 46 Weeks (considering typical paid vacation): £457.64/week * 46 weeks/year = £21,143.84

Important Points:

- These figures are approximations and do not include deductions for income tax, National Insurance, or other contributions, resulting in a lower actual take-home pay.

- The minimum wage represents the legal minimum an employer can pay; however, some employers may offer higher salaries based on factors such as job role, experience, or geographical location.

Strategies for Managing Minimum Wage Salary

Here are some effective strategies for managing a minimum wage salary and why they’re crucial:

Budgeting Tips for Living on a Minimum Wage Salary:

- Creating a Budget: Tracking income and expenses ensures you don’t overspend. Allocate funds for essentials like rent and food first, using budgeting tools for assistance.

- Prioritizing Needs: Distinguish between essentials and non-essentials, focusing on necessities.

- Cost-Saving Measures: Save money by cooking at home, using cheaper transportation, and comparing prices for groceries and utilities.

- Debt Management: Minimize debt through consolidation or repayment plans to reduce interest charges.

- Building an Emergency Fund: Set aside savings for unexpected expenses like car repairs or medical bills, gradually increasing the fund over time.

Seeking Opportunities for Skill Development and Career Growth:

- Identifying Skills Gaps: Improve your skillset, focusing on technical or transferable skills relevant to your job or desired career.

- Free or Low-Cost Training: Utilize resources like online courses, community programs, or government initiatives for skill development.

- Continuing Education: Pursue vocational training, online courses, or community college programs to enhance qualifications and competitiveness.

- Networking: Connect with professionals, attend industry events, and volunteer to build connections and opportunities.

Advocacy and Support for Minimum Wage Workers:

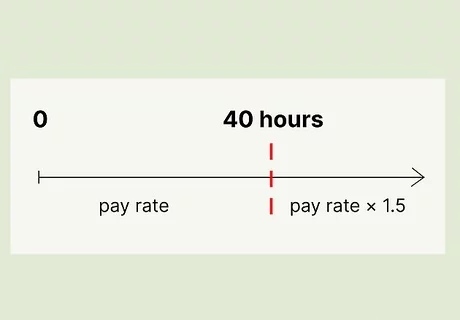

- Understanding Worker Rights: Know labor laws, minimum wage regulations, and overtime pay requirements.

- Building Solidarity: Connect with fellow workers to advocate for policy improvements and raise awareness about worker rights.

- Seeking Government Support: Stay informed about minimum wage discussions and support policies for a living wage.

Combining these strategies ensures a comprehensive approach to managing a minimum wage salary, optimizing income, enhancing skills, and contributing to long-term improvements for workers.

FAQ

What is the minimum wage for someone working 40 hours a week in the UK?

As of April 1, 2024, the minimum wage for someone working 40 hours a week in the UK varies based on their age:

Age 21 and Over: For individuals aged 21 or over, the minimum wage is determined by the National Living Wage (NLW), which stands at £11.44 per hour. Working 40 hours per week at this rate results in a:

- Weekly Salary: £11.44/hour * 40 hours/week = £457.64

Under 21: If the worker is under 21, their minimum wage is lower and depends on their specific age and, in some cases, their stage in an apprenticeship program. Here’s an overview (which doesn’t apply since you asked about 40 hours):

- Under 19 or 19+ in First Year of Apprenticeship: The minimum wage aligns with the lowest tier of the National Minimum Wage (NMW) system, currently set at £6.40 per hour.

- 19-20 (2nd Year+): As apprentices progress in their programs (usually in the second year or beyond), they qualify for the regular NMW based on their age group, which is typically higher than the initial apprentice minimum wage.

Important Notes:

- To calculate yearly salary for a 40-hour workweek, multiply the weekly salary by the number of working weeks in a year (usually 52). However, this calculation doesn’t consider deductions like taxes, National Insurance, or other contributions, which reduce your actual take-home pay.

- If you’re interested in the minimum wage for someone under 21 working 40 hours a week, you’d need specific details about their age and apprenticeship stage (if applicable).

How much does a full-time worker earn on the minimum wage?

A full-time worker’s earnings at the minimum wage in the UK depend on two main factors:

Age (as of April 1, 2024):

- 21 and Over: Workers aged 21 or over qualify for the National Living Wage (NLW), currently set at £11.44 per hour.

- Under 21: The minimum wage is lower for workers under 21, and it varies based on their specific age and, if applicable, their stage in an apprenticeship program.

Let’s focus on someone aged 21 or over working full-time:

Defining Full-Time: Full-time work typically ranges from 35 to 40 hours per week, depending on the industry and job. For our example, we’ll consider a 40-hour workweek.

Calculating Weekly Salary:

Weekly salary = Hourly wage * Working hours Weekly salary = £11.44/hour * 40 hours/week = £457.64

Yearly Salary Estimates (before deductions):

You can estimate the yearly salary in two ways, depending on whether you account for paid holidays:

- 52 Weeks (no deductions for holidays): £457.64/week * 52 weeks/year = £23,797.60

- 46 Weeks (considering typical paid vacation): £457.64/week * 46 weeks/year = £21,143.84

Important Notes:

- These figures are estimates and don’t consider deductions for income tax, National Insurance, or other contributions, which would lower your actual take-home pay.

- The minimum wage is the legal minimum an employer can pay. Some employers may offer higher salaries based on factors like job type, experience, or location.

If you’re curious about the minimum wage for someone under 21 working full-time, you’d need specific details about their age and apprenticeship stage (if applicable). Their minimum wage would be lower than the NLW mentioned earlier.

What is the minimum wage in the UK for 37.5 hours a week?

The minimum wage in the UK for an individual working 37.5 hours per week is determined by their age as of April 1, 2024:

Age 21 and Over: Individuals aged 21 or over are entitled to the National Living Wage (NLW), which currently stands at £11.44 per hour. Working 37.5 hours a week at this rate equates to:

- Weekly Salary: £11.44/hour * 37.5 hours/week = £429.00

Under 21: For those under 21, the minimum wage varies based on their specific age and, in some cases, their stage in an apprenticeship program. Here’s a breakdown (not applicable as you asked about 37.5 hours):

- Under 19 or 19+ in First Year of Apprenticeship: The minimum wage is set at the lowest tier of the National Minimum Wage (NMW) system, which is currently £6.40 per hour.

- 19-20 (2nd Year+): Apprentices progressing beyond their first year typically qualify for the regular NMW based on their age group, which is generally higher than the initial apprentice minimum wage.

Important Notes:

- This figure represents gross pay before any deductions for taxes, National Insurance, or other contributions. Your actual take-home pay will be lower.

- To determine the minimum wage for someone under 21 working 37.5 hours a week, you would need information about their specific age and apprenticeship stage (if applicable).

Are there different minimum wage rates for younger workers?

In the UK, there are distinct minimum wage rates for younger workers compared to those aged 21 and over, effective from April 1, 2024:

National Living Wage (NLW):

- Applicable to workers aged 21 and above, the current NLW stands at £11.44 per hour.

National Minimum Wage (NMW):

- Applicable to workers under 21, the NMW has varying rates based on age and, in some cases, apprenticeship stage:

- Under 19 or 19+ in First Year of Apprenticeship: £6.40 per hour

- 18-20: £8.60 per hour

- 16-17: There’s a specific minimum wage for certain situations, such as working alongside studies, typically lower than other age groups.

Important Notes:

- These rates are per hour; the actual minimum wage depends on the weekly hours worked.

- As apprentices progress in their programs (usually beyond the first year), they qualify for the standard NMW corresponding to their age group, typically higher than the initial apprentice rate.

- For detailed National Minimum Wage rates, refer to the UK government website: https://checkyourpay.campaign.gov.uk/

Useful Resources:

- GOV.UK – National Minimum Wage: https://checkyourpay.campaign.gov.uk/

- Minimum Wage Calculator: https://checkyourpay.campaign.gov.uk/ (This tool helps determine your minimum wage based on age and location)

How do I calculate my monthly salary on the minimum wage?

To determine your monthly earnings on the minimum wage in the UK, consider these steps:

- Minimum Wage Rate:

This varies based on age (as of April 1, 2024):

- 21 and Over: The rate aligns with the National Living Wage (NLW) at £11.44 per hour.

- Under 21: The National Minimum Wage (NMW) applies, with rates varying by age and, if relevant, apprenticeship stage.

- Weekly Working Hours:

Understand your typical work hours each week.

- Monthly Salary Calculation:

There are two primary methods to estimate your monthly income:

- Simplified 4-week Month (excluding holiday deductions): Calculation: Weekly wage * 4 weeks/month

- More Accurate Approach (factoring in average working weeks per month): Calculation: Weekly wage * 4.33 weeks/month (approximately)

Example Calculation for 21 and Over Worker at 40 Hours/Week:

- Hourly Wage: £11.44

- Weekly Salary: £11.44/hour * 40 hours/week = £457.64

- Monthly Salary (4-week Month): £457.64/week * 4 weeks/month = £1,830.56

- Monthly Salary (Average Working Weeks): £457.64/week * 4.33 weeks/month = £1,990.73

Key Points to Note:

- These figures are pre-deductions (taxes, National Insurance, etc.), so your actual net pay will be lower.

- Adjust calculations accordingly for under-21 workers or different work schedules.

- The 4.33 weeks/month average may vary due to month-specific factors like public holidays.

- For precise calculations, use tools like the Minimum Wage Calculator (https://checkyourpay.campaign.gov.uk/) and HMRC Tax Estimator (https://www.gov.uk/browse/tax/income-tax).

Hi there! I’m Loanna Morrison, a dedicated Civil Servant serving the public interest within the UK government. With a passion for ensuring fair labor practices and equitable treatment in the workforce, I’m deeply committed to advocating for policies that promote the well-being of workers across the United Kingdom.

As the mind behind MinimumWageUK.co.uk, I strive to provide valuable resources and up-to-date information regarding minimum wage regulations in the UK. With a focus on transparency and accessibility, my goal is to empower both employees and employers with the knowledge they need to navigate the complexities of minimum wage laws effectively.

With years of experience in public service and a keen understanding of labor policies, I’m here to support individuals and businesses alike in achieving compliance and fostering a workplace environment that values and respects the contributions of every worker.

Join me in the pursuit of a fairer, more equitable labor landscape for all. Together, we can make a meaningful difference in the lives of workers across the UK.