National Minimum Wage UK April 2025 [Living Wage rates]

Minimum Wage refers to the legally established lowest wage rate that employers can pay their employees for their labor. It is designed to ensure that workers receive fair compensation for their work, helping to prevent exploitation and poverty-level wages.

The purpose of minimum wage laws is multifaceted. Primarily, they aim to protect workers from being paid unreasonably low wages that could leave them struggling to meet their basic needs such as food, shelter, and healthcare. Minimum wages also plays a role in promoting economic stability by increasing consumer purchasing power and reducing income inequality, ultimately contributing to a healthier economy.

The concept of a minimum wages has roots dating back to the late 19th and early 20th centuries. During this time, industrialization led to harsh working conditions and extremely low wages for many workers. Various labor movements and advocacy groups emerged, pushing for reforms to improve working conditions and ensure fair compensation. One of the landmark events in the history of minimum wages legislation was the Fair Labor Standards Act (FLSA) passed in the United States in 1938. This act established a federal minimum wages and set standards for overtime pay, child labor, and recordkeeping. Since then, minimum wage laws have evolved globally, with many countries enacting their own minimum wage policies tailored to their economic and social contexts.

What Is Minimum Wage UK?

In the UK, the lowest hourly pay workers get depends on how old they are and if they’re apprentices. You can find out the current rates and get help if you think you’re paid less than the minimum wages by checking the right places.

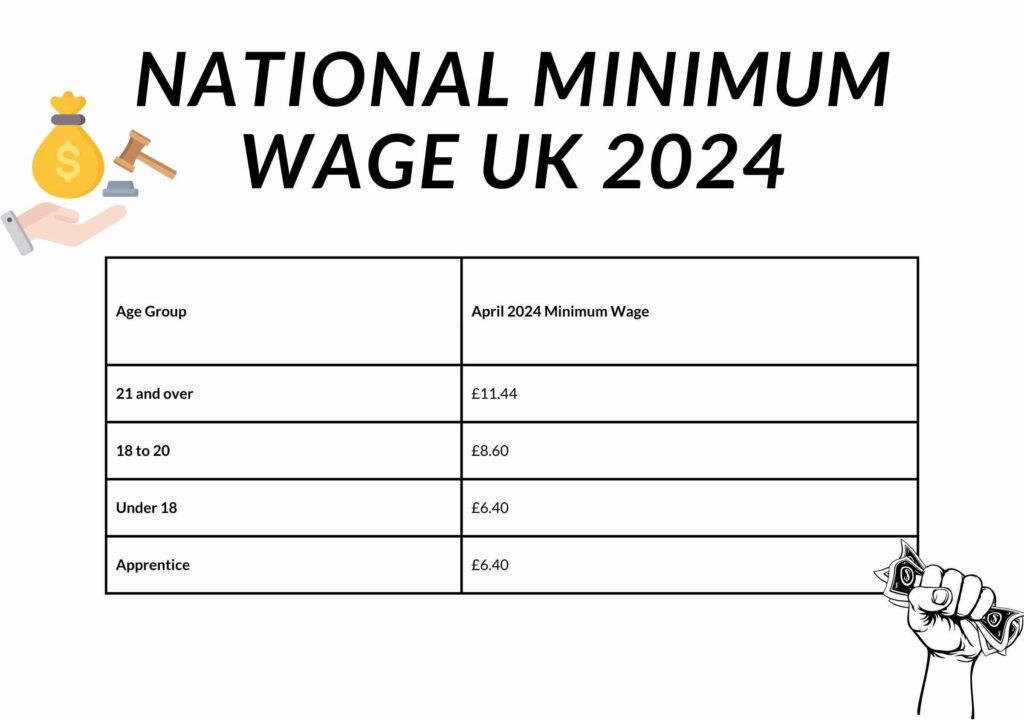

Current Minimum Wage Rates:

The current rates apply to the National Living Wage (for individuals aged 21 and over) and the National Minimum Wages (for those of at least school leaving age). These rates are updated annually on 1 April.

| Age Group | April 2024 Minimum Wage |

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

Previous Minimum Wages Rates

The rates listed below were applicable to the National Living Wages and the National Minimum Wages starting from April 2017.

Rates from 1 April 2021

Before 1 April 2024, the National Living Wages applied to those aged 23 and over.

| Age Group | April 2023 to March 2024 | April 2022 to March 2023 | April 2021 to March 2022 |

| 23 and over | £10.42 | £9.50 | £8.91 |

| 21 to 22 | £10.18 | £9.18 | £8.36 |

| 18 to 20 | £7.49 | £6.83 | £6.56 |

| Under 18 | £5.28 | £4.81 | £4.62 |

| Apprentice | £5.28 | £4.81 | £4.30 |

Rates before 1 April 2021

Before 1 April 2021, the National Living Wages applied to those aged 25 and over.

| Age Group | April 2020 to March 2021 | April 2019 to March 2020 | April 2018 to March 2019 |

| 25 and over | £8.72 | £8.21 | £7.83 |

| 21 to 24 | £8.20 | £7.70 | £7.38 |

| 18 to 20 | £6.45 | £6.15 | £5.90 |

| Under 18 | £4.55 | £4.35 | £4.20 |

| Apprentice | £4.15 | £3.90 | £3.70 |

Please note that the rates mentioned are in effect for the specified time periods, and the age groups and rates may have changed since then.

Minimum Wage Rates For Agricultural Workers:

In Northern Ireland, agricultural workers are subject to the Agricultural Minimum Wages rates instead of the National Minimum Wages (NMW) or National Living Wages (NLW), provided that the Agricultural Minimum Wages rate is higher. While no worker can receive less than the NMW or NLW, certain agricultural workers must be compensated at a higher rate due to the existence of the Agricultural Minimum Wages rate. These rates are revised annually in April.

| Grade | Rates from April 2022 |

| Grade 1 – minimum rate applicable for the first 40 weeks cumulative | £6.95 |

| Grade 2 – standard worker | £7.49 |

| Grade 3 – lead worker | £9.36 |

| Grade 4 – craft grade | £10.06 |

| Grade 5 – supervisory grade | £10.59 |

| Grade 6 – farm management grade | £11.50 |

These rates represent the minimum hourly wages before accounting for tax and national insurance deductions.

Should the National Minimum Wages (NMW) or the National Living Wages (NLW) surpass the hourly rates stated above at any given time, the minimum wages will be adjusted to match the NMW or NLW.

What is Minimum Wage For 16 Year Old?

In the UK, the minimum wage you get depends on how old you are. For example, if you’re 16 or 17, starting from April 1, 2024, you should be paid at least £6.40 per hour.

Here’s a simple breakdown of the current minimum wage rates in the UK based on age:

| Age Group | April 2024 Minimum Wage |

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

However, once they turn 19 and complete their first year, they get the minimum wages for their age group.

For more detailed information, you can check these resources:

- Official government website for National Minimum Wages and National Living Wages rates: [link]

- Information on minimum wage for different age groups, including young workers: [link]

Keep in mind:

- Although the minimum wages for 16 and 17-year-olds is £6.40, some jobs, your experience, or where you work might pay more.

- If you’re unsure about your minimum wages, it’s a good idea to ask your employer or check the government websites mentioned above.

What is Minimum Wage For 18 Year Old?

In the UK, your minimum wages depends on how old you are. If you’re an 18-year-old worker starting from April 1, 2024, you fall under the National Minimum Wage category.

The current National Minimum Wage for workers aged 18 to 20 is £8.60 per hour. This means that according to the law, your employer must pay you at least this amount for your work.

Here’s a summary of the UK minimum wage rates (as of April 1, 2024):

| Age Group | April 2024 Minimum Wage |

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

(Note: Apprentices get the minimum wages for their age once they turn 19 and complete the first year of their apprenticeship)

For more detailed information about minimum wages rates and regulations in the UK, you can visit these official websites:

- National Minimum Wages and National Living Wages rates: https://checkyourpay.campaign.gov.uk/

- What is the minimum wages – National Minimum Wage: [https://www.acas.org.uk/national-minimum-wage-entitlement/who-gets-the-minimum-wage]

Keep in mind:

- While the National Minimum Wages is the legal minimum, some employers may pay higher wages depending on the job, location, or company policies.

- If you’re unsure about your minimum wage or have any questions about your pay, it’s best to talk to your employer or seek advice from organizations like the Advisory, Conciliation, and Arbitration Service (ACAS).

What is Minimum Wage For 17 Year Old?

| Age Group |

April 2024 Minimum Wage

|

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

- National Minimum Wages and National Living Wages rates: https://checkyourpay.campaign.gov.uk/

- What is the minimum wages – National Minimum Wages: https://www.acas.org.uk/national-minimum-wages-entitlement/who-gets-the-minimum-wage]

- The minimum wages is the legal minimum, and some employers might pay higher wages based on the job role, location, or company policies.

- If you’re unsure about the minimum wages that applies to you or have any questions about your pay, it’s best to discuss with your employer or seek advice from organizations like the Advisory, Conciliation, and Arbitration Service (ACAS).

What is Minimum Wage For 21 Year Old?

In the UK, how much minimum wages you get depends on your age. If you’re a 21-year-old worker, starting from April 1, 2024, you’re likely eligible for the National Living Wages.

Here’s a comparison between the National Living Wages and the National Minimum Wage:

- The National Living Wage is usually higher than the National Minimum Wage.

- Most workers aged 23 and above qualify for the National Living Wage, with some exceptions like apprentices in their first year.

For a 21-year-old worker in the UK, the minimum wages is likely £11.44 per hour (as of April 1, 2024) under the National Living Wage category.

Here’s a summary of the UK minimum wages rates (April 2024):

| Age Group | April 2024 Minimum Wage |

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

(Note: Apprentices receive the minimum wages for their age once they turn 19 and complete the first year of their apprenticeship)

For more information about UK minimum wage rates and regulations, you can visit these official websites:

- National Minimum Wage and National Living Wages rates: https://checkyourpay.campaign.gov.uk/

- What is the minimum wage – National Minimum Wages: https://www.acas.org.uk/national-minimum-wage-entitlement/who-gets-the-minimum-wage

Keep in mind:

- The National Living Wages is the legal minimum for most 21-year-olds, but some employers may pay even higher wages based on factors like job roles, locations, or company policies.

- If you’re unsure about your minimum wage or have questions about your pay, it’s best to discuss with your employer or seek advice from organizations like the Advisory, Conciliation, and Arbitration Service (ACAS).

What is Minimum Wage For 19 Year Old?

| Age Group |

April 2024 Minimum Wage

|

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

- National Minimum Wages and National Living Wages rates: https://checkyourpay.campaign.gov.uk/

- What is the minimum wages – National Minimum Wage: https://www.acas.org.uk/national-minimum-wage-entitlement/who-gets-the-minimum-wage

- The National Minimum Wages sets the legal minimum, but some employers may offer higher wages based on the job, location, or company policy.

- If you’re unsure about your minimum wage entitlement or have questions about your pay, it’s advisable to discuss with your employer or seek guidance from organizations like the Advisory, Conciliation, and Arbitration Service (ACAS).

Who Gets The Minimum Wages In UK?

In the UK, most workers get either the National Minimum Wages or the National Living Wages, depending on how old they are. This applies to different types of jobs, like full-time or part-time work, training for a job, and even jobs in small businesses or new companies.

Who Gets Minimum Wage:

Here are the main groups of workers who usually get minimum wage:

- People who work for an agency

- Farm workers (though their minimum wage can change depending on where they work in the UK)

- Apprentices (after their first year, they get minimum wage for their age)

- Part-time or temporary workers

- New employees still on probation

- Workers from other countries

- People who work from home

- Offshore workers

- Sailors

- People paid based on how much they sell or make

- People with zero-hours contracts

Who Doesn’t Get Minimum Wage:

There are some exceptions where people don’t get minimum wages:

- People who work for themselves (because they choose to be self-employed)

- Volunteers (because they’re not paid for their work)

- Business owners

- Military members

- Students doing work experience for school

- People who are just watching and learning at work

- Kids who are still in school

Useful Info: To find out more about minimum wages rates and rules in the UK, you can check these links:

- National Minimum Wages and National Living Wages rates: https://checkyourpay.campaign.gov.uk/

- What is the minimum wages – National Minimum Wage: https://www.acas.org.uk/national-minimum-wage-entitlement/who-gets-the-minimum-wage

If you need more help understanding minimum wages or how it affects you, these resources can be a good place to start.

When Increases Paids Are Paid?

Here are the three main reasons why an employee might start earning a higher minimum wages:

- Government Update: The most common reason is when the government raises the minimum wage rates, often done in April each year.

- Age-Related Increase: Workers who turn 18 or 21 get a pay boost because they move into a new age bracket.

- Apprenticeship Progress: Apprentices can earn more once they turn 19 or finish their first year of training.

When Does the New Pay Start?

It’s crucial to know that the higher minimum wage doesn’t kick in right away. It begins with the next pay period after the increase takes effect.

Understanding Pay Periods:

This is the time covered by one payment cycle. It depends on how often your employer pays you:

- Daily pay: Pay period is 1 day

- Weekly pay: Pay period is 1 week

- Monthly pay: Pay period is 1 month The pay period can’t be longer than a month.

Example:

Let’s say the minimum wage goes up on April 1st. Sam gets paid monthly, from the 16th of one month to the 15th of the next. Sam would receive the old rate for April 1st to April 15th (part of the previous pay period). But from April 16th onwards (the start of the next pay period), Sam would get the new, higher minimum wage.

Key Point:

Employees might see a delay in the increased minimum wages due to their employer’s payment schedule and pay period system.

How to Check Your Pay?

Here’s how to check your pay and understand minimum wages calculations in the UK. Here’s a breakdown of the key points:

Verifying Your Pay:

- Use the National Minimum Wages and National Living Wages calculator on GOV.UK: https://www.gov.uk/am-i-getting-minimum-wage This tool helps you determine if you’re receiving the correct minimum wage based on your age and whether you’ve been paid correctly in previous years.

Calculating Your Average Hourly Rate:

- Divide your gross pay (total pay before taxes) for a pay reference period by the total number of hours you worked during that period.

Example:

- You receive a weekly salary of £460 (before tax) and work 40 hours a week. You’re over 24 and not an apprentice.

- Your average hourly rate is £11.50 (£460 divided by 40). This is above the minimum wage for your age group.

Payments Excluded from Minimum Wage Calculation:

- Certain types of payments don’t count towards the minimum wage:

- Tips and gratuities

- Premium payments (e.g., overtime pay, holiday pay)

- Loans or salary advances from your employer

Example:

- You’re 22 years old, not an apprentice, and receive a weekly salary of £540 (before tax), which includes £100 in tips.

- For minimum wage calculations, consider only the base pay of £440 (£540 total – £100 tips).

- Your average hourly rate is £11 (£440 divided by 40), which falls below the minimum wage for your age group. In this case, your employer needs to ensure your total pay (including tips) brings your average hourly rate to at least £11.44.

Commission:

- Commission payments count towards the minimum wage. Your total pay, including commission, must meet the minimum wage for each pay period. If your commission doesn’t reach the minimum wage threshold, your employer is required to “top up” your pay to meet it.

Deductions from Minimum Wage:

- Some deductions from your gross pay are allowed, but these shouldn’t bring your take-home pay below the minimum wage. Allowable deductions include:

- Taxes and National Insurance contributions

- Repaying advances or overpayments

- Pension contributions

- Trade union fees

- Charges for employer-provided accommodation (specific rates apply)

Important Note:

- Certain deductions and work-related expenses cannot reduce your pay below the minimum wage. These include:

- Tools

- Uniforms

- Travel costs (except commuting to and from work)

- Mandatory training course fees

Additional Resources:

For more detailed information on minimum wage calculations and allowable deductions, refer to the GOV.UK resource: https://www.gov.uk/am-i-getting-minimum-wage

By understanding how to check your pay and calculate your average hourly rate, you can ensure you’re receiving at least the minimum wages mandated by law.

What If An Employer Paid You Less than Minimum Wage?

Here’s you know that what to do if an employer pays less than the minimum wages in the UK. Here’s a summary of the key points:

Being Underpaid by Your Employer:

- It’s illegal for an employer to pay you less than the National Minimum Wage or National Living Wage (depending on your age).

- Employers are also obligated to keep accurate pay records and provide them to you upon request.

Resolving the Issue:

- If you suspect you’re being underpaid, the first step is to try resolving it informally.

- You can use the government’s calculator to check the minimum wage for your age category.

- Review your payslips and employment contract for any discrepancies.

- Talk to your employer directly to address the issue.

Formal Procedures:

- If informal resolution fails, you can pursue formal channels:

- Raise a Grievance: File a formal complaint directly with your employer.

- Complain to HMRC: You can anonymously report the underpayment to HMRC, the UK’s tax authority.

- Employment Tribunal Claim: File a legal claim against your employer at an employment tribunal.

HMRC Enforcement:

- HMRC investigates complaints and can take action against employers who underpay:

- Issuing fines up to £20,000 per employee affected.

- Taking legal action, including criminal proceedings.

- Publicly listing the employer’s name.

Employment Tribunal Claims:

- You can file a claim at an employment tribunal to recover unpaid wages.

- The claim period is typically 2 years back from the underpayment.

- Strict time limits apply for filing claims (usually 3 months minus 1 day from the underpayment).

Protection Against Retaliation:

- You’re protected by law from being treated unfairly by your employer if you:

- Become eligible for a higher minimum wage.

- Assert your right to minimum wage.

- File a complaint with HMRC or an employment tribunal.

Examples of unfair treatment:

- Reduced work hours

- Bullying or harassment

- Denied training or promotion opportunities

Seeking Further Help:

- The Advisory, Conciliation and Arbitration Service (ACAS) offers support and advice on resolving minimum wage issues.

Key Resources:

- National Minimum Wages and Living Wage calculator: https://www.gov.uk/am-i-getting-minimum-wage

- Making a claim to an employment tribunal: https://www.gov.uk/courts-tribunals/employment-tribunal

- Acas helpline: Contact details can be found on the GOV.UK website.

Remember, it’s important to understand your rights and take action if you believe you’re being underpaid. The resources provided can guide you through the process.

Importance of Minimum Wages

The National Minimum Wages (NMW) in the UK serves as a legal baseline for hourly pay, with significant implications across several key areas:

Economic Stability:

- Positive Impact: By raising the income of low-wage workers, the NMW can increase consumer spending, potentially boosting economic activity and GDP.

- Potential Challenges: Setting the NMW too high could strain businesses, leading to reduced hiring and potential job losses, which may hinder economic growth.

Reducing Income Inequality:

- Intended Effect: The NMW targets the lowest earners, aiming to narrow income gaps and promote fairer income distribution.

- Considerations: While it addresses low-wage disparities, it may not address overall wealth inequality, and there are debates about its impact on higher-paid workers and internal wage structures in certain sectors.

Improving Standard of Living:

- Core Objective: Ensuring workers can afford essentials like housing and healthcare, leading to an improved quality of life.

- Indirect Benefits: A higher NMW can result in a healthier, more productive workforce, reduce poverty, and alleviate social costs.

Overall, the NMW’s impact on the UK economy is multifaceted. While it can contribute positively to economic stability, income equality, and living standards, finding a balance is crucial to avoid unintended consequences.

Additional Considerations:

- The NMW undergoes regular reviews to align with the cost of living.

- Different NMW rates exist based on age and apprenticeship status.

- Debates persist regarding the NMW’s overall effectiveness and its broader impacts on the economy and society.

Arguments for Minimum Wages

The National Minimum Wages (NMW) in the UK is backed by compelling reasons. Here’s a breakdown of why it’s beneficial, along with some additional points:

Ensuring Fair Compensation:

- Preventing Exploitation: The NMW stops employers from underpaying vulnerable workers and promotes fairness in pay.

- Boosting Morale: Fair wages can enhance worker morale, leading to better job satisfaction and productivity.

Stimulating Consumer Spending:

- Increased Purchasing Power: More income for low-wage earners means more spending on essentials and other goods, benefiting businesses and the economy.

- Economic Growth: Higher consumer spending can fuel economic activity and potentially create more jobs.

Supporting Workers’ Rights:

- Empowering Negotiation: The NMW gives workers bargaining power and prevents employers from exploiting their need for work.

- Poverty Reduction: A minimum wage can lift workers and their families out of poverty, enabling better participation in society.

Additional Arguments:

- Reduced Income Inequality: By targeting low-wage earners, the NMW helps bridge income gaps and promotes a fairer distribution of wealth.

- Improved Standard of Living: Better wages lead to improved living conditions, impacting health and crime rates positively.

- Less Reliance on Welfare: With enough income from work, fewer people need government assistance.

While debates exist, especially regarding potential job losses, the NMW’s advantages outweigh concerns. It contributes to a fairer economy and supports the rights and well-being of low-income workers in the UK.

Minimum Wages Policies Around The World

The UK’s National Minimum Wages (NMW) policy is intriguing when viewed in a global context of minimum wage practices. Here’s a detailed look at the points you asked about:

Examples of Effective Minimum Wage Policies (Globally & in the UK):

- Addressing Income Inequality:

- Successful models in Nordic countries demonstrate that robust minimum wages policies, along with strong social safety nets, can significantly reduce income inequality. The UK’s NMW, while impactful, should be considered within broader income distribution policies.

- Enhancing Living Standards:

- Countries like Australia and New Zealand showcase how a well-executed minimum wage can elevate living standards for low-income workers without impeding economic growth. The UK’s NMW has made strides in this direction, albeit with debatable impact.

- Boosting Consumer Spending:

- Observations from the United States, with its federal minimum wages, suggest that higher minimum wages can lead to increased spending among low-wages earners, stimulating economic activity. The UK’s NMW likely contributes similarly, depending on the wage levels set.

Regarding the UK’s NMW:

- The practice of regularly reviewing and adjusting the NMW to keep up with living costs is a commendable aspect.

- The differentiated rates based on age groups acknowledge varying experience and skill levels to a certain degree.

Challenges in Implementing Minimum Wage (Globally & in the UK):

- Potential Job Losses:

- A global concern is that excessively high minimum wages could deter businesses from hiring, particularly affecting low-skilled workers. The UK must balance the NMW with job creation policies.

- Enforcement Hurdles:

- Ensuring universal compliance with the NMW, especially in informal sectors, presents enforcement challenges. The UK must strengthen monitoring mechanisms to uphold the NMW’s efficacy.

- Impact on Small Businesses:

- Small enterprises may struggle with abrupt minimum wage increases. The UK could consider phased adjustments or tailored support for these businesses.

Additional Considerations:

- The effectiveness of minimum wage policies hinges on economic context, social support systems, and overall wage structures.

- The UK’s NMW is part of a broader labor framework and should be evaluated alongside other regulations and worker safeguards.

By analyzing global successes and challenges, the UK can refine its NMW policy to achieve fair pay, reduce income disparity, and enhance living standards for low-wage workers effectively.

FAQ

The UK’s current minimum wage varies based on the worker’s age:

- Workers aged 23 and over receive £11.44 per hour, known as the National Living Wage, the highest rate within the National Minimum Wages system.

- For younger workers:

- Workers aged 21-22 receive £10.18 per hour.

- Workers aged 18-20 receive £8.60 per hour.

- Apprentices aged 19 or older in their first year receive £6.40 per hour. (Note: Upon completing their first year and still being 19 or older, they move to the minimum wage rate for their age group.)

In the UK, 16-year-olds and 17-year-olds are covered by the same minimum wage rate. As of today, April 2024, both age groups are entitled to £6.40 per hour.

The National Living Wage in the UK for 2024 is £11.44 per hour. This applies to workers aged 23 and over. It’s important to note that the National Living Wage is the highest tier of the National Minimum Wage structure in the UK.

Who Qualifies for the National Minimum Wages (NMW) and National Living Wage (NLW) in the UK:

National Minimum Wage (NMW):

- Applies to all individuals classified as “workers” under UK law, regardless of nationality.

- To qualify for the NMW, a worker must have reached at least the school leaving age, which is typically the last Friday in June of the school year they turn 16.

National Living Wage (NLW):

- This represents the highest rate within the NMW structure.

- Eligibility for the NLW requires a worker to be 23 years or older and classified as a “worker” under UK law.

Definition of a “Worker” under UK Law:

The definition of a “worker” under UK law encompasses various employment arrangements, including:

- Employees under traditional employment contracts

- Agency workers

- Casual laborers

- Piecework earners (paid based on the number of items produced)

- Apprentices (those aged 19 or over in their first year qualify for a reduced NMW rate, then transition to the NMW for their age group)

Not Considered “Workers” under UK Law:

Independent contractors are typically excluded from the “worker” category and are therefore not entitled to the NMW or NLW.

Here are the current minimum wages rates in the UK effective from April 6, 2024:

| Age Group | April 2024 Minimum Wage |

| 21 and over | £11.44 |

| 18 to 20 | £8.60 |

| Under 18 | £6.40 |

| Apprentice | £6.40 |

Important points to note:

- There isn’t a separate minimum wages rate for 16 and 17-year-olds; they are included in the same minimum wages categories as 18-20 year olds, which is £6.40 per hour.

- While the National Living Wages is recommended for workers aged 23 and over, it technically remains the highest level within the National Minimum Wages structure.

The UK minimum wage covers a wide range of workers, but there are specific conditions for eligibility:

- Worker Classification:

- The minimum wages is applicable to all individuals classified as “workers” under UK law, regardless of their nationality, extending beyond typical employees on contractual terms.

- Minimum Age Requirement:

- To qualify for the National Minimum Wages (NMW), a worker must have reached at least the school leaving age. In the UK, this age corresponds to the last Friday in June of the school year in which the worker turns 16.

- National Living Wage (NLW) vs. National Minimum Wages:

- The National Living Wage (NLW) represents the highest rate within the NMW structure. To be eligible for the NLW, a worker must be aged 23 or above and still categorized as a “worker” under UK law.

- Examples of Eligible Workers:</strong>

- Workers likely falling under the “worker” classification and thus potentially eligible for the NMW or NLW include employees with traditional employment contracts, agency workers, casual laborers, piecework-based pay employees, and apprentices (those aged 19 or older in their first year qualify for a lower NMW rate initially, transitioning to the NMW for their age group thereafter).

- Ineligibility for Independent Contractors:

- Independent contractors, generally not falling under the “worker” category, are not eligible for the NMW or NLW.

For more detailed information, reliable resources such as GOV.UK’s National Minimum Wages and National Living Wages page (https://checkyourpay.campaign.gov.uk/) and ACAS’s guide on who qualifies for the minimum wages (https://www.acas.org.uk/national-minimum-wages-entitlement/who-gets-the-minimum-wages) can be referred to.